HONG KONG (Dow Jones Investment Banker) – It’s gone largely unnoticed against the background of some eye-catching equity deals in Asia in the first half of the year – including the listings of Glencore, Hutchison Port Holdings Trust, Samsonite and Prada S.p.A. – and the recent market meltdown, but 2011 has so far been a pretty good year for convertible bonds.

The combination of inflationary worries, high volatility, shaky primary equity markets and redemptions by issuers from jurisdictions that traditionally see significant equity-linked issuance (such as Taiwan and South Korea) has fuelled a number of transactions, including some pretty sizeable deals.

As bankers have now been forced to pull new listings and follow-on offerings, or to dream up alternatives such as demergers and spin-offs, the flexibility offered by convertible bonds means that deals can still get done – even in the current environment.

Data from Dealogic shows that a total of 104 convertible bond issues have been completed this year in the region, for a total amount of US$18.9 billion equivalent. That compares with a volume of US$22.8 billion for the whole year in 2009, when 195 deals closed, and of US$34 billion in 2010, with 229 new issues.

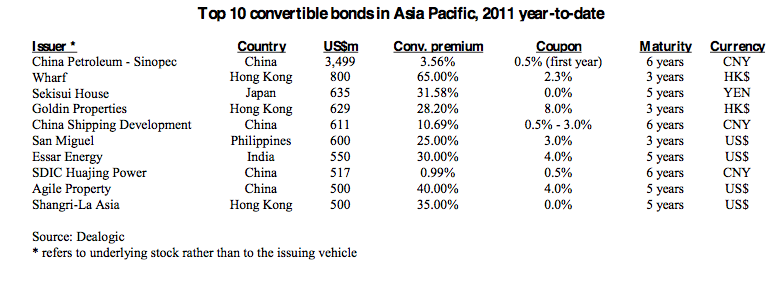

This year’s convertibles have also been relatively large in size. All of the top 30 deals were for an amount greater than US$200 million, with 12 above the US$500 million mark, including a jumbo US$3.5 billion yuan-denominated, A-share convertible bond issue by China’s oil giant Sinopec Corp. Three yuan-denominated deals have also featured in the top 10, for a combined amount of about US$4.6 billion equivalent. Other currencies of choice have been the US dollar and the yen.

Issuers have been getting a pretty good deal too, with an average conversion premium of more than 24% for the top 30 issues, and an average coupon of only 1.4%. More than a dozen transactions were able to post zero coupons.

The 2011 year-to-date regional equity-linked bookrunner league table, as computed by Dealogic, is dominated by Goldman Sachs, followed by Credit Suisse and UBS, with Nomura Co. Ltd. and JPMorgan – two firms that historically have had active convertible bond platforms – close behind.

The 2011 year-to-date regional equity-linked bookrunner league table, as computed by Dealogic, is dominated by Goldman Sachs, followed by Credit Suisse and UBS, with Nomura Co. Ltd. and JPMorgan – two firms that historically have had active convertible bond platforms – close behind.

Not surprisingly, investment banks in Hong Kong have been busy growing their CB platforms to originate new business. Standard Chartered plc just hired Derrick Wong from Credit Suisse to rebuild its business, after suffering three defections to Deutsche Bank in May. Daiwa Co. Ltd. signed on Macquarie Group Ltd. banker Oliver Nighjoy in April to build up its primary issuance capabilities, and to capitalize on the 2010 acquisition of KBC Bank N.V.’s global convertibles and Asian equity derivatives business. Tak Loon Chai is soon to join Nomura from Deutsche to look after derivative solutions, while CB veteran Maartje Bus has gone to Royal Bank of Scotland, following stints at Citigroup, ABN AMRO Bank N.V., and ICAP plc.

With the bearish events of the last couple of weeks putting increasing pressure on deal sizes and valuations, the convertible bond market remains open for issuers that would now be unable to tap hedge funds and long-only investors for equity.

As share prices slowly recover, and credit spreads narrow, the market can expect good performance for these instruments too – provided that liquidity doesn’t evaporate in a re-run of 2008. For now, it would seem a good time to go fishing for opportunities.

(Philippe Espinasse worked as an investment banker in the U.S., Europe and Asia for more than 19 years, and now writes and works as an independent consultant in Hong Kong. Visit his website at https://www.ipo-book.com. Readers should be aware that Philippe may own securities related to companies he writes about, may act as a consultant to companies he mentions and may know individuals cited in his articles. To comment on this column, please email [email protected]).

[This article was originally published on Dow Jones Investment Banker on 11 August 2011 and is reproduced with permission.]

Copyright (c) 2011, Dow Jones & Company, Inc.