Hong Kong Exchanges and Clearing Limited’s (HKEx) Cash Market Transaction Survey 2009/2010 (covering HKEx’s securities market turnover from October 2009 to September 2010) found that the contribution to the total trading value of HKEx’s securities market from local and overseas investors continues to be well balanced.

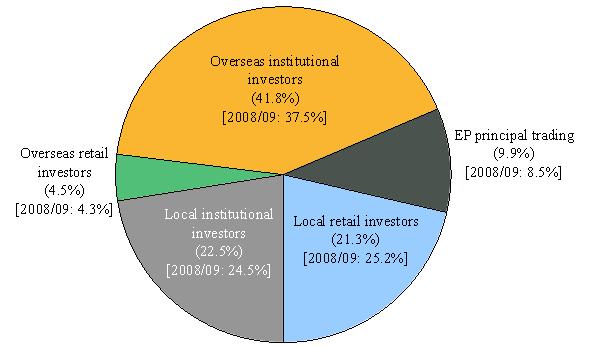

In 2009/2010, overseas investors contributed 46% of total market turnover value, up from 42% in 2008/2009, while local investors contributed 44%, down from 50% in the previous year. Institutional investors contributed 64% of total market turnover value (62% in 2008/2009), remaining above 60% for the fifth consecutive year. The contribution from retail investors was 26% in 2009/2010, down from 30% in the previous year.

Other key findings of the survey were as follows:

– overseas institutional investors, the largest contributors among all investor types, contributed 42% of total market turnover, up from 38% in 2008/2009;

– local institutional investors contributed 23% to total market turnover, compared to 24% in 2008/2009;

– local retail investors contributed 21% to total market turnover, compared to 25% in 2008/2009; and

– Exchange participants’ principal trading contributed a record high of 10% of total market turnover in 2009/2010, up from 8% in 2008/2009.

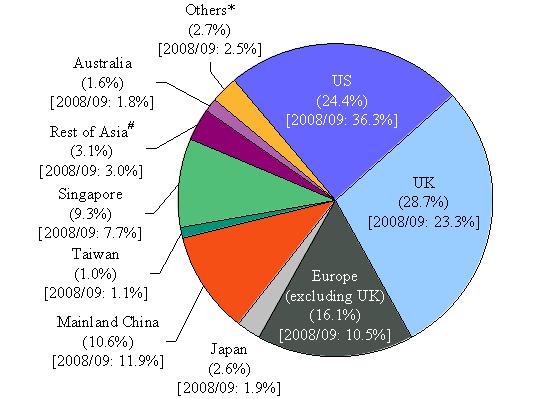

Findings regarding trading value by overseas investors showed that:

– UK investors regained their status as the largest contributors to overseas investor trading in 2009/2010 with a contribution of 29%, up from 23%;

– US investors, ranking behind UK investors for the first time since surpassing them in 2004/2005, contributed 24% of overseas investor trading, down sharply from 36% in 2008/2009;

– the contribution from continental European investors to overseas investor trading rebounded from 10% in 2008/2009 to 16%, ranking third among overseas investors;

– the contribution of investors from mainland China to overseas investor trading was 11% in 2009/2010, compared to 12% in 2008/2009; and

– Asian investors in aggregate contributed 27% of overseas investor trading in 2009/2010, compared to 26% in the preceding year.

| # Reported origins in “Rest of Asia” were Brunei, Cambodia, India, Indonesia, Kazakhstan, Korea, Laos, Macau, Malaysia, Myanmar, Pakistan, Philippines, Sri Lanka, Thailand and Vietnam.

* Reported origins in “Others” included Anguilla, Argentina, Bahamas, Bahrain, Belize, Bermuda, Brazil, British Virgin Islands, Canada, Cayman Islands, Chile, Colombia, Cyprus, Dubai, Ecuador, Fiji, Gambia, Ghana, Guatemala, Isle of Man, Israel, Jamaica, Kuwait, Liberia, Marshall Islands, Mauritius, Mexico, New Zealand, Oman, Panama, Qatar, Republic of Seychelles, Saint Kitts and Nevis, Samoa, Saudi Arabia, South Africa, Turkey, United Arab Emirates and Venezuela. – Note: Numbers may not add up to 100% due to rounding. |