25 April 2011

HONG KONG (Dow Jones Investment Banker) – Russian President Dmitry Medvedev and his entourage were all smiles when they visited the Stock Exchange of Hong Kong’s trading hall Sunday. But listing Russian companies in Hong Kong still faces technical and regulatory hurdles, as well as in many cases an uphill struggle to convince investors in Asia that Russian stocks have a place in their portfolios.

read

HONG KONG (Dow Jones Investment Banker) – Fitness First is likely to apply to Singapore’s SGX this month for an eligibility-to-list letter for an IPO, with a launch this July. The business, which has been listed before in the UK, has a wide footprint and boasts impressive statistics, as well as a clear ability to generate cash (2009 EBITDAwas US$238 million equivalent). We look at the group, and at the possible shape the IPO might take.

read

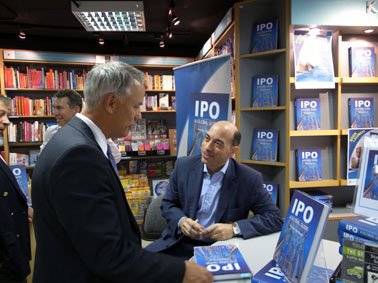

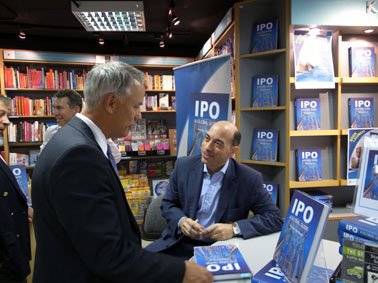

“IPO: A Global Guide” was formally launched on 15 April 2011 at Kelly & Walsh in Exchange Square in Hong Kong. The event was well attended, and saw the author signing a number of copies of the book. The attendees came from a variety of backgrounds and included, among others, ECM bankers, research analysts, traders, company directors, lawyers, investors, students and journalists.

read

Glencore International plc filed today an announcement detailing the terms of its proposed US$9 billion to US$11 billion flotation on the LSE and the Stock Exchange of Hong Kong. The filing reveals a transaction mainly comprised of new shares to be issued, as well as the prominent role played in the deal by Morgan Stanley and Citi.

read

HONG KONG (Dow Jones Investment Banker) – Another week, another beauty pageant for a multi billion- dollar IPO in Hong Kong. In local fashion, Guangdong Development Bank (GDB) is said to be meeting brokers next Sunday and Monday to select bookrunners for a capital raising of up to US$4 billion, with a dual listing in Shanghai and Hong Kong.

read

HONG KONG (Dow Jones Investment Banker) – The US$1.44 billion IPO and listing in February on the London Stock Exchange of Justice Holdings Ltd. marks something of a revival for special purpose acquisition companies. It raises the question: Why are SPACs yet to make it big in Asia, which last year accounted for more than 54% by volume of IPOs globally? They could do well in Hong Kong in particular.

read

HONG KONG (Dow Jones Investment Banker) – With the lure of diamonds and soaring multiples in the jewelry sector, the jockeying is now on to become a bookrunner for the IPO of Chow Tai Fook Jewellery Co. Ltd. The offering, in Hong Kong, is expected to raise some US$3 billion.

read